|

| Cash Flow Forecast Excel Template Free Download |

Financial Forecast Excel Template Free Download

Cash flow is the net amount of cash and cash equivalents being transferred into and out of a business. Cash received represents inflows, while money spent represents outflows.

At a fundamental level, a company’s ability to create value for shareholders is determined by its ability to generate positive cash flows or, more specifically, maximize long-term free cash flow (FCF). FCF is the cash that a company generates from its normal business operations after subtracting any money spent on capital expenditures (CapEx).

How to Use Financial Forecast Excel Template

Save the template (XLT file) to your computer. Double-click on it to create a new plan, then follow these steps:

Step 1: Set a starting point for your projections Start date 1/1/2021

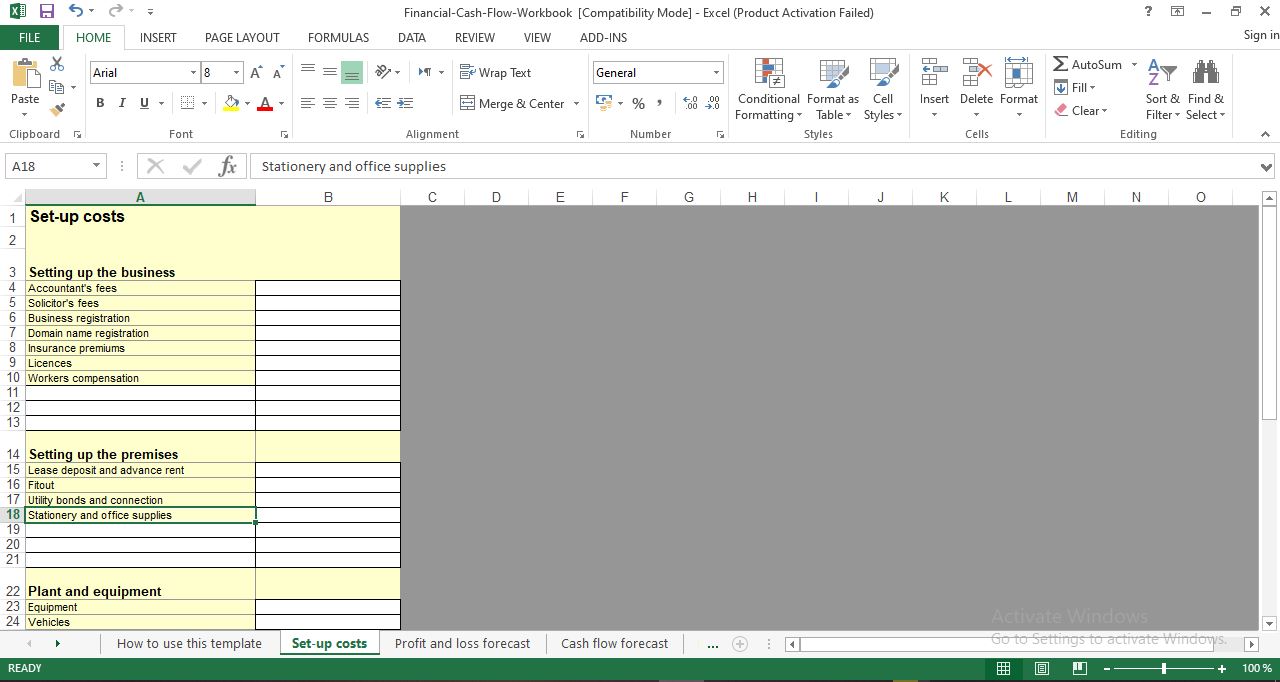

Step 2: Set-up costs Use the set-up costs sheet to calculate the cost of setting up your business.

|

| Set-up costs template |

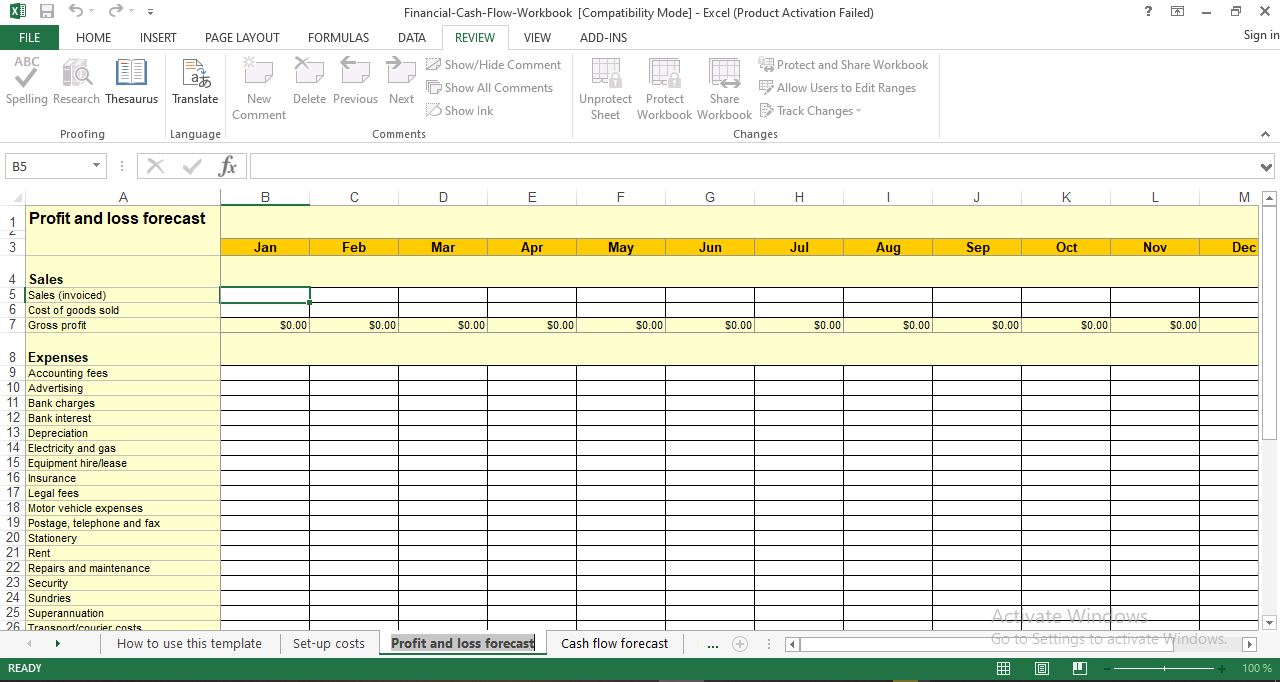

Step 3: Profit and loss forecast - Forecast your month-by-month profit and loss for the first 12 months of operations. Enter sales in the month when they're invoiced, rather than the month when they're paid.

|

| Profit and loss forecast excel template |

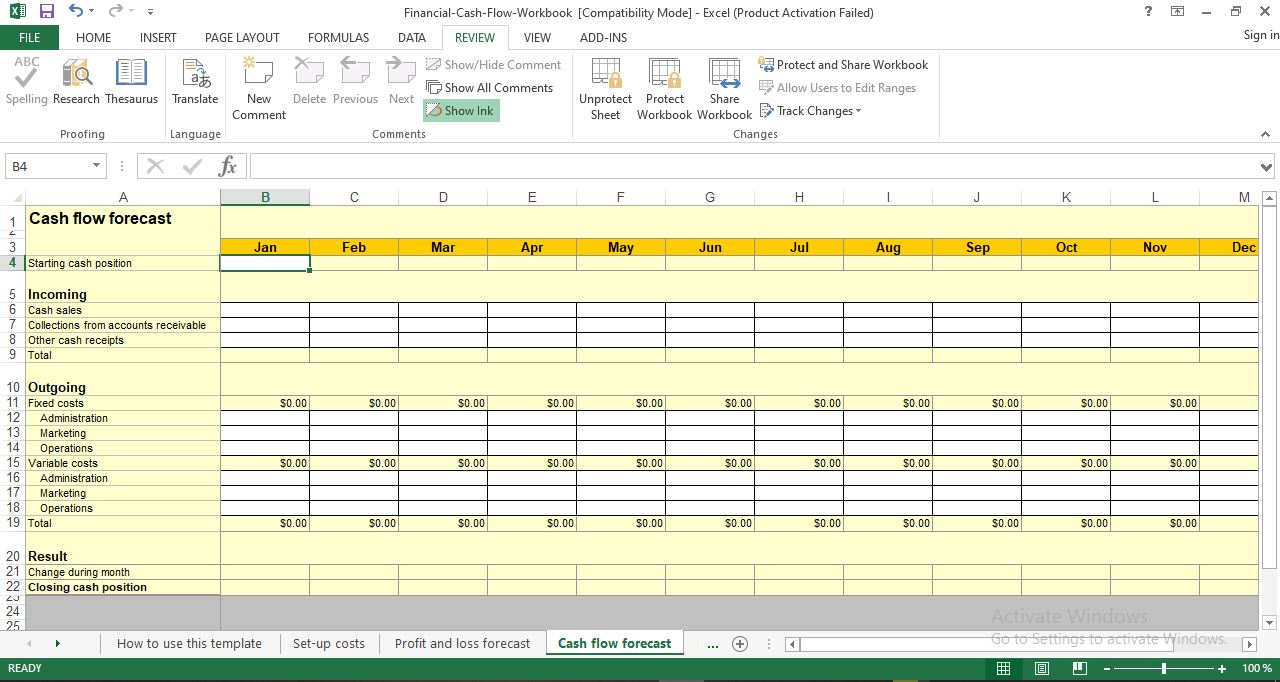

Step 4: Cash flow forecast - Forecast your month-by-month cash flow for the first 12 months of operations. Enter sales revenue in the month when it's received, rather than the month when it's invoiced.

|

| Cash flow forecast excel template |

Step 5: Balance sheet forecast - Forecast your balance sheet position at the end of the first 12 months of operation. The balance sheet draws on the figures you've entered in your profit and loss forecast.

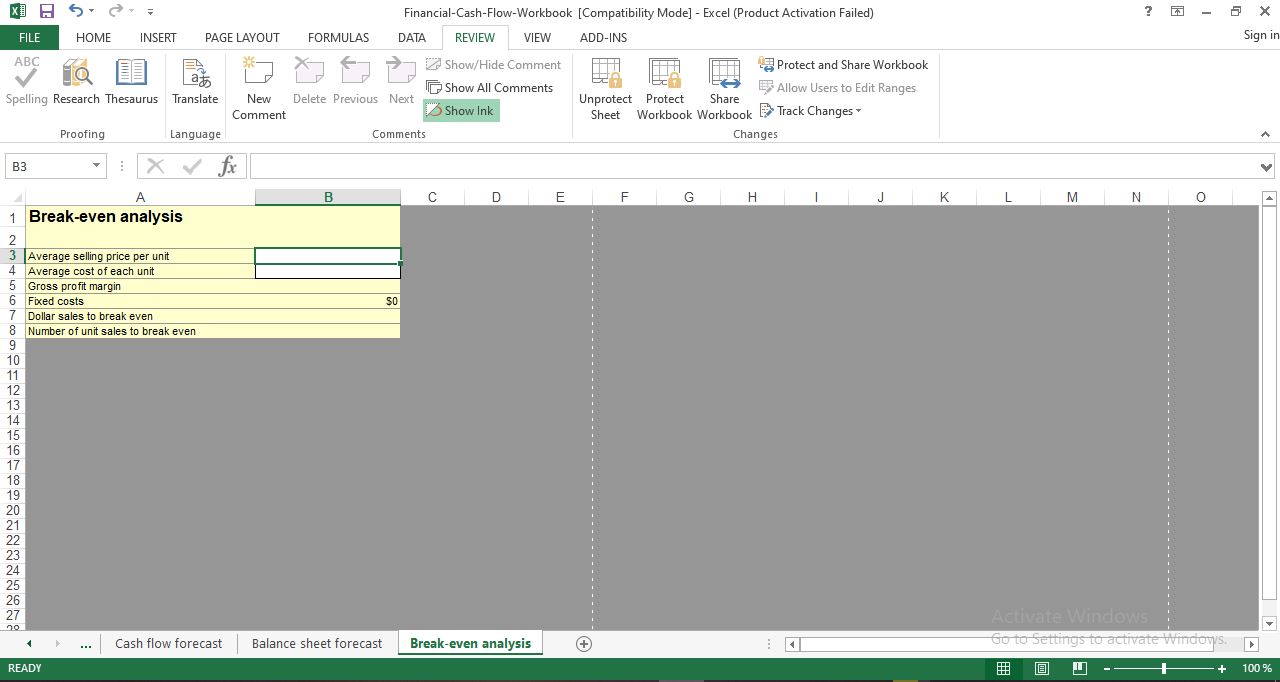

Step 6: Break-even analysis Find out how many sales you need to make in the first 12 months to cover your fixed costs and break even.

Download also:

Post a Comment